17 Ways to Save Over a Thousand Dollars a Year and Still Have Fun

Did you know that you can save money and still have fun?

There are many creative ways to save money and still have an enjoyable life. I am excited to share some simple and practical ways to save some mullah as well as some awesome apps, resources and printables to help you achieve your goals. Disclosure: This post contains affiliate links which means if you buy something through my link, I may get a small share of the sale at no extra cost to you. Please see our disclosure page for more information.

Disclosure: This post contains affiliate links which means if you buy something through my link, I may get a small share of the sale at no extra cost to you. Please see our disclosure page for more information.

Let’s start saving!

1. Make your coffee at home.

Let’s say you purchase 5 cups of coffee a week at $4 a day. Over the course of the year you could be spending $1,040 on coffee! Save coffee dates for special occasions instead of daily.

2. Bring your lunch from home.

Here is another fun scenario to look at. Let’s say you go out for lunch 5 days a week with an average price of $6 per meal. After a span of the 52 weeks in the year you could spend over $1500 on lunch. When ever possible bring your lunch with you and you could be saving over a $1000 a year!

3. Tricks to save when you go out to eat.

Skip the $7 appetizer. Instead of buying two plates at $12 each, costing you $24 you could get one large plate at $18 and share. I know it sounds boring, but drink water. A beverage can cost you anywhere from $3 – $15 depending on what you are getting. Eat dessert at home or split a dessert. So for example, if the hubby and I went out to eat and got a $7 app, two entree plates at $12 each, two drinks at $10 each and dessert at $6 it would cost us: $57 plus tip. Or If we shared one large plate and drank water it would cost $18 plus tip. That is a savings of $39!

4. Skip the concessions stand.

At the movie theater, skip the concessions stand. The food and beverages are typically way over priced!

5. Buy groceries on sale and use coupons.

Stock up on items you use often when they are on sale. Buy fruits and veggies when they are in season. When purchasing organic produce stick to the dirty dozen. Remember to check for coupons and Ibotta rebates before you go to the store.

6. Make a grocery list.

Have you ever gone to the store for milk but come home with three bags full of food, but you forgot the milk? Guilty here! I noticed that if I do not go to the store with a list and a plan than I tend to wonder and find random things I do not need. After checking for coupons make a list and stick to it.

7. Utilize your freezer.

We stock up on meat and store it in the freezer. I also like to make large batches of soup and freeze the leftovers to be used on a busy day. Before my daughter was born, I made a lot of slow cooker freezer meals and it was a life saver! Check out this Pinterest board to see where I found my inspiration.

8. Use grocery shopping rebate apps.

There are quite a few rebate shopping apps out there but my favorite is Ibotta. I have learned to only use the app on things that I really need or are already on my list. I do not purchase an item just because it is a great deal. One of the coolest parts about Ibotta is the fact that you can link up with your friends and help each other to get more rebates and deals. Use my Ibotta referral link and get a $10 bonus with your first rebate.

9. Utilize the Costco Visa Card

If you are a Costco shopper then I highly recommend the Costco Visa card. There is no annual membership other than your regular Costco membership. You can make 4% back on gas on the first $7000 per year and 1% thereafter. 3% cash back on eligible restaurant and travel purchases. 2% cash back on all Costco purchases and 1% cash back on all other purchases. If you shop there as much as we do this can really pay off. Make sure that you only spend what you can afford and pay off your card every month.

10. Buy clothes on sale.

We try not to buy anything at full price. Buying clothing on sale and off season can save you a lot of money. But don’t buy something just because it is one sale! Only purchase items that you know you need. Garage sales and consignment sales can save you a lot of money on baby clothes.

11. Get your nails done for special occasions.

Getting a manicure and pedicure feels amazing, but getting them done regularly can really add up! My most recent mani pedi cost me $40. If I had this done every other month it would cost me $240 a year. And that is just for a regular mani pedi. Stick to doing your nails at home and make the mani pedi a treat on special occasions.

12. Host a potluck dinner.

It can be a lot of fun to go out to dinner with friends, and it can be really expensive. Instead of going out to eat with friends host a potluck style dinner at home. Everyone gets to save money and you get to spend time together. Plus the drinks are not going to set you back $10 each. Total win!

13. Find discount deals online.

There are quite a few sites that you can use to find great deals on fun things to do in your area. Our favorite is Groupon. You can also find some great deals at =assoc_tag_ph_1396452853174&_encoding=UTF8&camp=1789&creative=9325&linkCode=pf4&tag=mycom02620-20&linkId=b4e87839093aafdb24dbe001913788e0” target=”_blank” rel=“nofollow”> Amazon check to see your item is part of the daily deals or has a coupon you can apply.

15. Use Ebates!

Yes, I used an apostrophe for this one. How does Ebates work?“Ebates is the pioneer and leader of online cash back shopping. Ebates pays members cash back every time they shop online as well as provide them with the best coupons and deals online. Founded in 1998, Ebates Inc.‘s websites have paid over $325 million in cash to its members.” -Ebates.comThis is a no brainier if you ask me. We made $190 back last year from online purchases. Use my Ebates referral code and get $10 added to your first rebate.

16. Share the cost of travel with friends.

If you have been following shortsweetmom for a while then you know that our family loves to travel. Some of the ways we have been able to save money while traveling is utilizing Airbnb. It can be much more affordable to rent a house and split the cost with a group rather than getting individual hotel rooms. Use my Airbnb referral link and take $35 off your first vacation.Plan to stay in for some of your meals and split the cost of food with your group. Do your research before your trip and have a tentative plan in place. This way you will have an idea of how much you will be spending before you go on your trip.

17. Eliminate Debt

There is a serious side to saving money as well. To really make the most of your income, you will want to tackle your debt. My husband and I try to live a debt free lifestyle. What does that mean? It means we only buy things we can pay for upfront. We make it a point to pay off the credit card every month and our bills on time. We drive used cars and do not make large purchases often. Other than our house we have no debt. We are currently working on paying off our mortgage. Living a debt free lifestyle is definitely the way to go!If you would like to learn more about how to tackle your debt I recommend checking out “The Total Money Makeover“ by Dave Ramsey. His website also has many tips on tackling debt and budgeting as well as many other resources that can help you along your journey.

How much money can you save?

That is really up to you. Let’s look at a hypothetical scenario.Coffee at home: $1000Bagged lunch: $1500Ebates: $190Ibotta: $40Costco Visa: $300With these simple changes someone could save $3,030 in a year! Isn’t it amazing how quickly it all adds up!

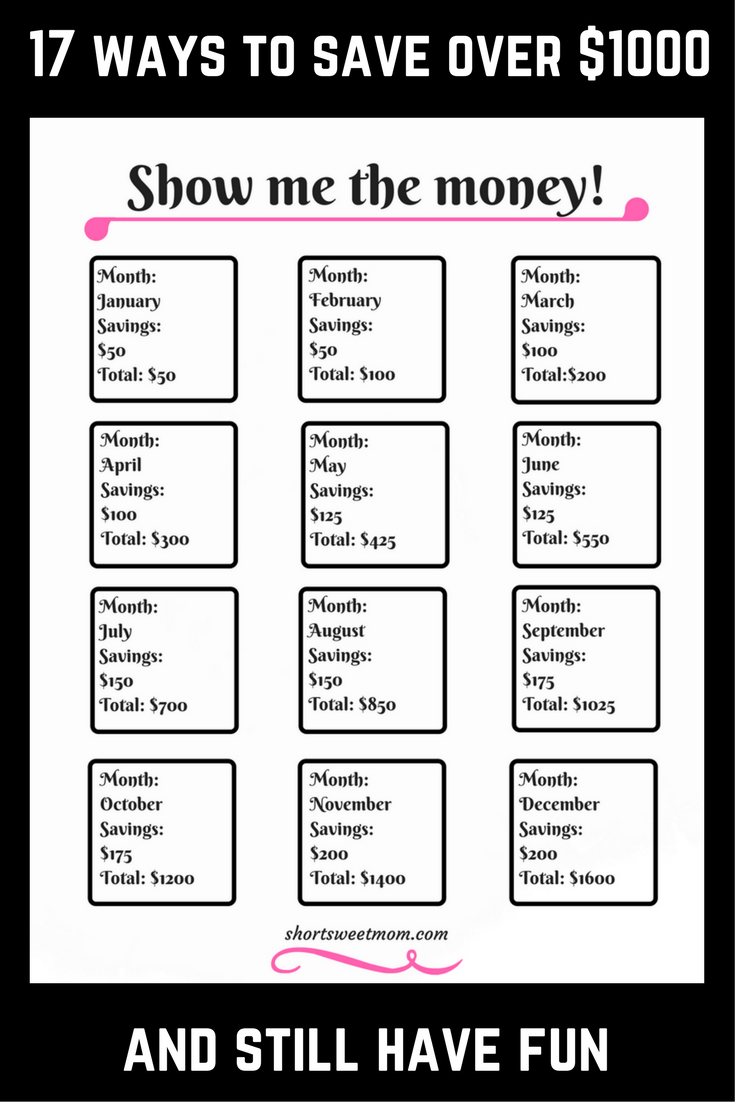

Get your printables.

I have included some great free printables to help you achieve your money saving goals. This includes a monthly savings chart. A chart to track your money saving goals and last but not least, a chart to help you keep track of the new ways you that you have saved. Part of the fun of saving money is seeing your progress!

I have included some great free printables to help you achieve your money saving goals. This includes a monthly savings chart. A chart to track your money saving goals and last but not least, a chart to help you keep track of the new ways you that you have saved. Part of the fun of saving money is seeing your progress!